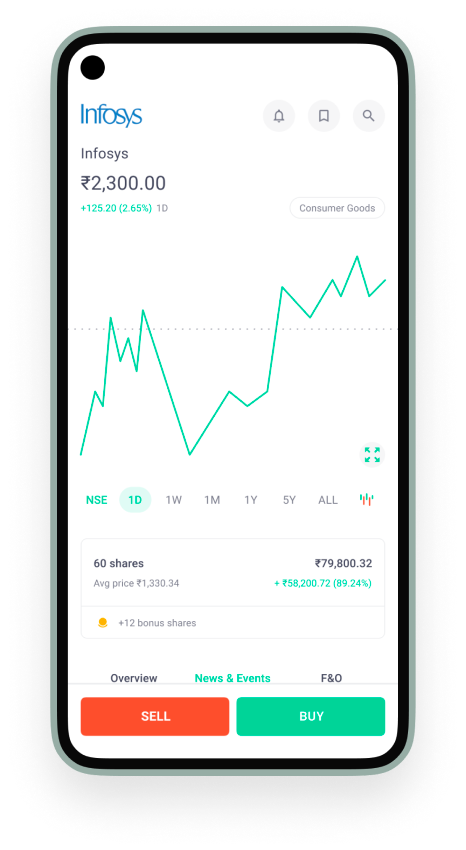

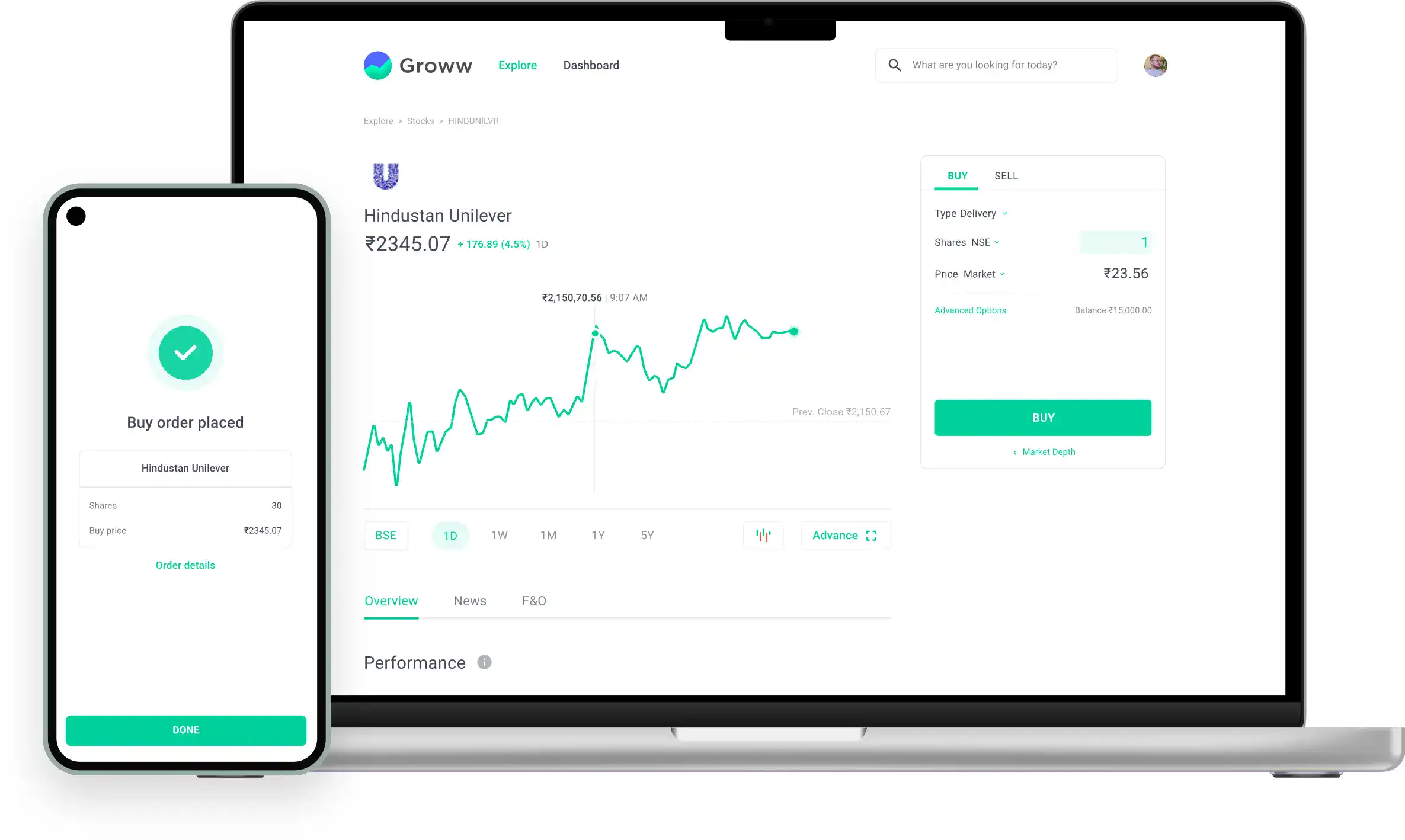

Power-packed with

everything you need.

everything you need.

Fast order execution.

Never miss a market move.

Place orders in a breeze.

Place orders in a breeze.

Secure your money,

not your worries.

Groww makes sure your data is safe.

Multi-level security

A robust encryption and multi-factor authentication makes sure

you can securely login and transact.

Active device management

Manage and monitor all the devices that are logged into your

Groww account, remotely.

MOST POPULAR ON GROWW

STOCK MARKET INDICES:

S&P BSE SENSEX |

S&P BSE 100 |

NIFTY 100 |

NIFTY 50 |

NIFTY MIDCAP 100 |

NIFTY BANK |

NIFTY NEXT 50

POPULAR MUTUAL FUNDS:

QUANT SMALL CAP FUND |

QUANT SMALL CAP FUND |

ICICI PRUDENTIAL COMMODITIES FUND |

ICICI PRUDENTIAL COMMODITIES FUND |

NIPPON INDIA SMALL CAP FUND |

NIPPON INDIA SMALL CAP FUND |

PARAG PARIKH FLEXI CAP FUND |

PARAG PARIKH FLEXI CAP FUND |

GROWW NIFTY TOTAL MARKET INDEX FUND |

GROWW NIFTY TOTAL MARKET INDEX FUND |

SBI SMALL MIDCAP FUND |

SBI SMALL MIDCAP FUND |

TATA DIGITAL INDIA FUND |

TATA DIGITAL INDIA FUND |

AXIS SMALL CAP FUND |

AXIS SMALL CAP FUND |

ICICI PRUDENTIAL TECHNOLOGY FUND |

ICICI PRUDENTIAL TECHNOLOGY FUND |

HDFC INDEX FUND SENSEX PLAN |

HDFC INDEX FUND SENSEX PLAN |

HDFC SMALL CAP FUND |

HDFC SMALL CAP FUND |

AXIS EQUITY FUND |

AXIS EQUITY FUND |

CANARA ROBECO SMALL CAP FUND |

CANARA ROBECO SMALL CAP FUND |

TATA SMALL CAP FUND |

TATA SMALL CAP FUND |

UTI NIFTY FUND

UTI NIFTY FUND

MUTUAL FUNDS COMPANIES: MUTUAL FUNDS COMPANIES:

GROWWMF |

GROWWMF |

SBI |

SBI |

AXIS |

AXIS |

HDFC |

HDFC |

UTI |

UTI |

NIPPON INDIA |

NIPPON INDIA |

ICICI PRUDENTIAL |

ICICI PRUDENTIAL |

TATA |

TATA |

KOTAK |

KOTAK |

DSP |

DSP |

CANARA ROBECO |

CANARA ROBECO |

SUNDARAM |

SUNDARAM |

MIRAE ASSET |

MIRAE ASSET |

IDFC |

IDFC |

FRANKLIN TEMPLETON |

FRANKLIN TEMPLETON |

PPFAS |

PPFAS |

PRINCIPAL |

PRINCIPAL |

QUANT |

QUANT |

L&T |

L&T |

INVESCO

INVESCO

USEFUL LINKS:

MUTUAL FUNDS |

SIP CALCULATOR |

CAGR CALCULATOR |

MUTUAL FUND SCHEMES |

MUTUAL FUND RETURNS CALCULATOR |

GST CALCULATOR |

FIND IFSC CODE |

UPCOMING IPO |

FINANCIAL TOOLS |

EMERGING MARKETS

TOOLS:

BROKERAGE CALCULATOR |

MARGIN CALCULATOR |

SIP CALCULATOR |

SWP CALCULATOR |

SUKANYA SAMRIDDHI YOJANA CALCULATOR |

MUTUAL FUND RETURNS CALCULATOR |

FD CALCULATOR |

RD CALCULATOR |

EMI CALCULATOR |

PPF CALCULATOR |

EPF CALCULATOR |

NPS CALCULATOR |

GRATUITY CALCULATOR

OTHERS:

NSE |

BSE |

Terms and Conditions |

Policies and Procedures |

Regulatory & Other Info |

Privacy Policy |

Disclosure |

Bug Bounty |

Download Forms |

Investor Charter and Grievance |

Redressal of Investor Grievances

Groww is India’s growing financial services platform where

users can find their investment solutions pertaining to

mutual funds, stocks, US Stocks, ETFs, IPO, and F&Os, to

invest their money without hassles.

Groww objectively evaluates stocks and mutual funds and does

not advise or recommend any stocks, mutual funds or

portfolios. Investors shall invest at their own discretion,

will and consent. Groww, at any time, does not guarantee

fixed returns on the capital invested.

Groww helps investors -

· By providing 100% paperless online free Demat and

trading account opening

· By providing an objective evaluation of products

available on the platform

· By being transparent about fees and charges involved

while investing in a product

· By offering decision-making assistance by providing

technical analysis with advanced charts, well-designed line

& candlestick charts that indicate share price

movements, and market indices, along with more details about

all registered and listed companies

SECURE TRANSACTIONS ON GROWW

All transactions on Groww are safe and secure. Users can

invest through SIP or Lumpsum using Netbanking through all

supported banks. It uses BSE Star MF

(with Member code 11724)

as the transaction platform.

TRADE AND INVEST SECURELY WITH GROWW

Stocks, Mutual fund investments, F&Os, etc., are very

popular with individual investors because of their numerous

benefits. On Groww, an investor can -

- Invest in Nifty 50 (NSE) & Sensex (BSE) listed stocks

- Diversify across multiple stocks and other instruments

- Start SIP with any amount (as low as Rs. 500)

- Switch regular funds to direct funds

- Start automated monthly investments (SIP), and benefit

from many more features

All types of mutual funds are available on Groww.

INVESTING IN MUTUAL FUND PORTFOLIOS

Portfolio is a collection of mutual funds designed to meet

your investment goals. Investing in mutual fund portfolios

helps you diversify your investments and reduce risk.

Portfolios also help you assign investment goals and make it

easy for you to save for and achieve your goals. You can

create a portfolio yourself or ask an expert to build it for

you.

ATTENTION INVESTORS

1. For Stock Broking Transaction 'Prevent unauthorized

transactions in your account --> Update your mobile

numbers/email IDs with your stock brokers. Receive

information of your transactions directly from the

Exchange on your mobile/email at the end of the

day...Issued in the interest of Investors.

2. For Depository Transaction 'Prevent Unauthorized

Transactions in your demat account --> Update your

Mobile Number with your Depository Participant.

Receive alerts on your Registered Mobile for all debit

and other important transactions in your demat account

directly from CDSL/NSDL on the same day...Issued in

the interest of investors.

3. KYC is a one-time exercise while dealing in

securities markets - once KYC is done through a SEBI

registered intermediary (Broker, DP, Mutual Fund

etc.), you need not undergo the same process again

when you approach another intermediary.

4. If you are subscribing to an IPO, there is no need

to issue a cheque. Please write the Bank account

number and sign the IPO application form to authorize

your bank to make payment in case of allotment. In

case of non-allotment, the funds will remain in your

bank account.

· Investors should be cautious about unsolicited emails

and SMS advising to buy, sell, or hold securities and

trade only on the basis of an informed decision. Investors

are advised to invest after conducting an appropriate

analysis of respective companies and not to blindly follow

unfounded rumors, tips, etc. Further, you are also

requested to share your knowledge or evidence of systemic

wrongdoing, potential frauds, or unethical behavior

through the anonymous portal facility provided on the BSE

& NSE website.

Awareness regarding guidelines on Margin collection

1. Stock Brokers can accept securities as margin from

clients only by way of pledge in the depository system

w.e.f. September 1, 2020.

2. Update your mobile number & email ID with your

stockbroker/depository participant and receive OTP

directly from the depository on your email ID and/or

mobile number to create a pledge.

3. Pay 20% upfront margin of the transaction value to

trade in the cash market segment.

4. Investors may please refer to the Exchange's Frequently

Asked Questions (FAQs) issued vide circular reference

NSE/INSP/45191 dated July 31, 2020, and NSE/INSP/45534

dated August 31, 2020, and other guidelines issued from

time to time in this regard.

5. Check your Securities /MF/ Bonds in the consolidated

account statement issued by NSDL/CDSL every month.

Issued in the interest of Investors

DISCLAIMER

Groww Invest Tech Pvt. Ltd. (Formerly known as Nextbillion

Technology Pvt. Ltd) (CIN: U65100KA2016PTC092879) is a

member of NSE & BSE with SEBI Registration no:

INZ000301838, Depository Participant of CDSL Depository with

SEBI Registration no: IN-DP-417-2019, and Mutual Fund

distributor with AMFI Registration No: ARN-111686.

Registered office and Correspondence office - No.11, 2nd

floor, 80 FT Road, 4th Block, S.T Bed, Koramangala,

Bengaluru – 560034. For any grievances related to Stock

Broking/DP, please write to [email protected], please

ensure you carefully read the Risk Disclosure Document as

prescribed by SEBI.

Procedure to file a complaint on SEBI SCORES: Register on

the

SCORES

portal. Mandatory details for filing complaints on SCORES:

Name, PAN, Address, Mobile Number, E-mail ID. Benefits:

Effective Communication, Speedy redressal of the grievances.

Groww Invest Tech Pvt. Ltd. (Formerly known as Nextbillion

Technology Pvt. Ltd) makes no warranties or representations,

express or implied, on products offered through the

platform. It accepts no liability for any damages or losses,

however caused, in connection with the use of, or reliance

on its product or related services. Unless otherwise

specified, all returns, expense ratio, NAV, etc., are

historical and for illustrative purposes only. Future will

vary greatly and depend on personal and market

circumstances. The information provided by our blog is

educational only and is not investment or tax advice.

Mutual fund investments are subject to market risks. Please

read all scheme-related documents carefully before

investing. Past performance of the schemes is neither an

indicator nor a guarantee of future performance.

Terms and conditions of the website/app are applicable. The

privacy policy of the website is applicable.